This is part two of my three posts on Learning to Trade. I felt inspired to write them after a couple of conversations with fellow retail traders.

In the first part, I tried to explain how I have found viewing trading as a game a more useful mindset than approaching it as work. I will try and expand on this here...

(Link to part 3 if you wish to continue reading)

Knowing the rules and the processes is the first part of learning anything, and technically, you will be able to "play" but you aren't going to be able to compete. To compete effectively in anything you need to build a healthy self-respect and confidence that you can only gain from truly understanding the game.

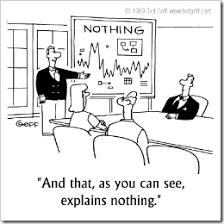

To me, after having learnt the processes, most traders, including myself, enter into one of two failure states. The problem as you will see, is that these two states are not based on your beliefs or in reality.

Blind-traders bastardise a setup up from a book, video or coach that they like and assume because they like it, that they believe in it. They work hard at adapting the setup into a strategy and because they don't want the work to have been in vain the "belief-lie" becomes bigger. They end up with a setup that is good but a system they have no faith in. Because of this lack of faith, they then start a campaign of constant "setup-tweaking". However, this means they are never able to learn their KPIs because the unit of measurement is always changing and so, the blind remain blind.

Testers hide behind backtesting, looking for the perfect way to exploit their "edge". But the problem is this trader hasn't spent any significant time trading it in real-time and are in a "reality-lie"; they have no idea if it suits their personality, or whether they can even see their setups when under the pressure of the market. So, when the rubber eventually hits the tarmac, the months of work have been for nothing, they have a "successful" strategy that they are unable to execute.

Personally, I spent about 7 years fucking around between these to states.

In my opinion, it doesn't really matter what style you choose as long as you believe in it. Muhammed Ali believed boxing was a war of attrition, while Mike Tyson saw it as a pistol draw. Neither style was infallible but they worked because they believed completely in their way. And to me this is the first step to truly playing any game; you have to play the game your way.

When I did the above roughly 18 months ago my trading transformed, my results went to break-even and slowly eked into profit and most importantly I lost the execution anxiety that had plagued me for years. I was able to enter trades when I saw them, I now have less issues holding through retracements and can manage and close them with far less emotional involvement. It was completely liberating. The irony is I was just doing what my coach had been telling me to do for two years.

I can't emphasise enough how important it is to trade the market in your vision.

Personally, I believe the market moves because of supply and demand (orders), central bank policy (because central banks control the supply of cash and interest payments) and sentiment ("uncertainty" and "stabilised uncertainty" create fear of losing it (FOLI) = supply, or greed, fear of missing out,(FOMO) = demand).

In the first part, I tried to explain how I have found viewing trading as a game a more useful mindset than approaching it as work. I will try and expand on this here...

(Link to part 3 if you wish to continue reading)

l-plates: knowing how to play a game is very different from knowing you can playing the game

Knowing the rules and the processes is the first part of learning anything, and technically, you will be able to "play" but you aren't going to be able to compete. To compete effectively in anything you need to build a healthy self-respect and confidence that you can only gain from truly understanding the game.

To me, after having learnt the processes, most traders, including myself, enter into one of two failure states. The problem as you will see, is that these two states are not based on your beliefs or in reality.

state 1: blind-trading

state 2: the testers

Personally, I spent about 7 years fucking around between these to states.

your way

In my opinion, it doesn't really matter what style you choose as long as you believe in it. Muhammed Ali believed boxing was a war of attrition, while Mike Tyson saw it as a pistol draw. Neither style was infallible but they worked because they believed completely in their way. And to me this is the first step to truly playing any game; you have to play the game your way.

- Decide how you believe the market works. Not how a book or your coach says (nb a good coach should make you decide yourself), why do you think markets move? what are you absolutely certain about? This is where you need to build everything from. From your beliefs/faith, not science, backtesting etc.

- Now you need to find or develop a style that allows you to trade the market in that vision.

- After finding your style and like my coach says, you then need to forward test it to 1. see if it suits you 2. see if it is practical to execute and 3. learn some early KPIs to make some basic adjustments to better your edge.

When I did the above roughly 18 months ago my trading transformed, my results went to break-even and slowly eked into profit and most importantly I lost the execution anxiety that had plagued me for years. I was able to enter trades when I saw them, I now have less issues holding through retracements and can manage and close them with far less emotional involvement. It was completely liberating. The irony is I was just doing what my coach had been telling me to do for two years.

I can't emphasise enough how important it is to trade the market in your vision.

Personally, I believe the market moves because of supply and demand (orders), central bank policy (because central banks control the supply of cash and interest payments) and sentiment ("uncertainty" and "stabilised uncertainty" create fear of losing it (FOLI) = supply, or greed, fear of missing out,(FOMO) = demand).